Indiana adopted a special trust form in 2019- the Legacy Trust. While this new trust form provides important asset protection benefits that did not previously exist under Indiana law, it has also caused some confusion. Many people mistakenly believe that Indiana’s Legacy Trust provides absolute and guaranteed protection of assets placed in the trust, while allowing the settlor/grantor of the trust to maintain control of the trust assets. Those things are untrue. In this article, we explore some of the benefits and limitations of Indiana’s Legacy Trust.

Indiana adopted a special trust form in 2019- the Legacy Trust. While this new trust form provides important asset protection benefits that did not previously exist under Indiana law, it has also caused some confusion. Many people mistakenly believe that Indiana’s Legacy Trust provides absolute and guaranteed protection of assets placed in the trust, while allowing the settlor/grantor of the trust to maintain control of the trust assets. Those things are untrue. In this article, we explore some of the benefits and limitations of Indiana’s Legacy Trust.

What is an asset protection trust?

Indiana’s Legacy Trust is often referred to as a “Domestic Asset Protection Trust” or “DAPT” for short. Asset Protection Trusts (“APT’s”) fall into one of three categories-

- Domestic Asset Protection Trusts

- Foreign Asset Protection Trusts

- Medicaid Protection Trusts

Generally, a trust holds the settlor’s (creator’s) assets for a beneficiary (receiver). When using a DAPT, like Indiana’s Legacy Trust, the settlor can be named as a beneficiary, but the settlor cannot directly control the trust and cannot have unfettered access to trust asset. The limitations on the settlor’s access to and control over trust assets are described in more detail below. What is important to understand here is that a DAPT protects trust assets from some, but not all, creditor claims, lawsuits, and judgments against the settlor, in exchange for the DAPT being irrevocable. There lies the trade-off. In order to gain some asset protection under a DAPT, the settlor cannot be the trustee, loses direct control over trust assets, and cannot revoke the DAPT or have assets transferred out of the DAPT back to the settlor.

Legacy Trust Requirements

There are specific requirements under Indiana’s new Legacy Trust Law in order to create a DAPT. The trust must be designated in writing that it is a legacy trust; include specific language required by the Indiana Code; and be accompanied by an affidavit with statutorily required statements. Once established, a legacy trust must be funded with assets, such as real estate, securities, bank accounts, cash, vehicles, or business ownership. A trust is “funded,” when assets are properly transferred into the trust, changing ownership of those assets to the trust.

Limited Protection of Assets

While Indiana’s Legacy Trust does provide new forms of asset protection that did not exist prior to 2019, there are several limitations on the protections afforded to assets in the trust.

- The settlor of an APT is not allowed to “hide” all their assets in a DAPT. The settlor cannot become insolvent by funding a DAPT.

- The settlor may only transfer assets into a DAPT for legitimate planning purposes and may not fund an DAPT as a “fraudulent transfer” to prevent known or anticipated creditors, including and expressly the State of Indiana, from reaching the settlor’s assets.

- No agreements or “understandings” allowing the settlor to have rights or authority with respect to the principal or income of the DAPT may exist and are automatically void by statute.

- A settlor cannot act as a Trustee or a Trust Director of the DAPT.

- A settlor cannot protect trust assets that are listed on an application or financial statement completed by the settlor or on behalf of the DAPT in connection with a request to obtain or maintain credit from a lender.

- Child support required by judgment or court order must be paid and can be taken from the legacy trust assets to satisfy the judgment or order.

- Assets are subject to division in a divorce case, when the transferred assets existed 30 days before the marriage occurred or during the marriage, unless notice, as required by statute, is provided to the spouse before the transfer is made to the DAPT.

- There is a 10-year “claw-back” that allows a bankruptcy trustee to take any asset placed in a DAPT within 10 years of a bankruptcy filed by the settlor.

- There is no protection against claims that arose before or within two (2) years of a transfer of assets to a DAPT.

The Legacy Trust Gives the Settlor Some Indirect Control

Even though a settlor of a Legacy Trust cannot be a Trustee or Trust Director, Indiana’s statute creating the Legacy Trust does give the settlor some influence on how trust assets are used-

- Settlor can act as an investment advisor to the legacy trust.

- Settlor can veto a distribution from the legacy trust.

- Settlor can remove and appoint new trustees or trustee directors, so long as that appointee is not the settlor, related to the settlor or subordinate to the settlor within the meaning Section 672(c) of the Internal Revenue Code.

- Settlor’s use of the income or principal of the legacy trust is permitted, so long as it was a result of the qualified trustee’s actions that were within the qualified trustee’s discretion and in compliance with the terms of the DAPT and Internal Revenue Code. This can include use of real property held by the legacy trust, so long as it complies with all the terms of trust and the Internal Revenue Code.

- Legacy trusts are still subject to the rules against perpetuities, so the trust will have to terminate at some point in the future.

Is the Legacy Trust a good choice for you?

Some of our clients will greatly benefit from the Legacy Trust, but, for most of our clients, the Legacy Trust is going to have limited application. Every person’s circumstances, wishes, assets, challenges and needs differ. So, you will need a team of dependable professionals to help you in deciding how best to plan your estate and protect your assets. Please seek advice from a knowledgeable estate planning lawyer and CPA.

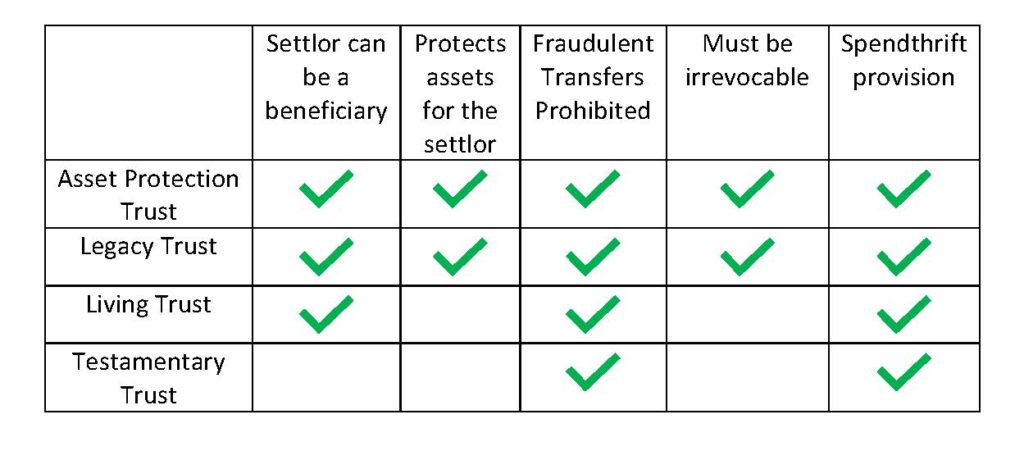

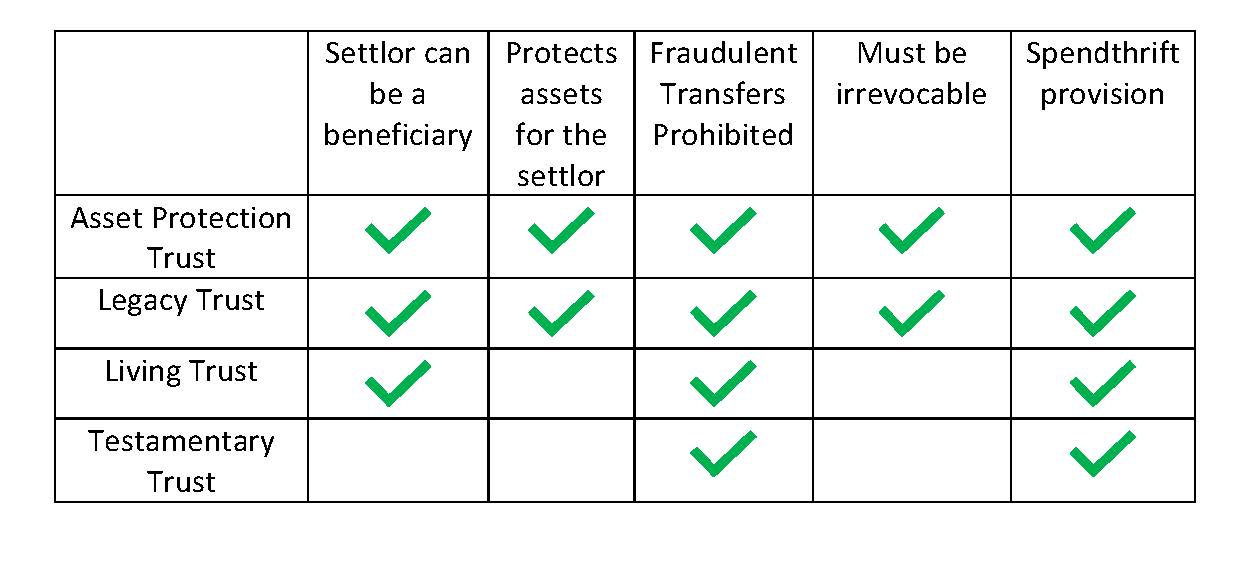

Below, we have provided a chart that helps to explain some of the different types of trusts that the attorneys at GRIFFITH XIDIAS LAW GROUP routinely use for their clients-