UPDATE: We have posted a more detailed analysis of the Series LLC for real estate investments/deals. You can read that article HERE.

UPDATE: We have posted a more detailed analysis of the Series LLC for real estate investments/deals. You can read that article HERE.

The Indiana Series LLC is so new that the rules, regulations, processes and law on this new business model are incomplete and undecided. Because Indiana only adopted a law permitting the Series LLC effective January 1, 2017, there will be legal and tax issues that will not be answered for years. While it may become a preferred business structure for some businesses, it is not a good choice today for most business owners. Read on to learn more about the myths and realities of this new law.

“Our fear as business and real estate lawyers is that business owners will rush to form Series and Series LLCs, because of the hype.”

Matthew A. Griffith, Senior Attorney

What is an Indiana Series LLC?

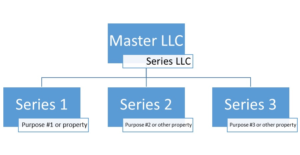

A “Series LLC” is a limited liability company with multiple and separate business purposes or investment goals being subdivided into groups, with each group being called a “series.” In other words, a “Series LLC” is a limited liability company with multiple and separate business purposes or investment goals being subdivided into groups, with each group being called a “series.”

Because the new Indiana law introduces new legal terms, the following simplified definitions might be helpful. Let’s start with the existing legal terms-

- “Limited liability company,” “interest,” “member,” “manager,” and other similar terms are defined under the new law as they were defined under the old law- the Indiana Business Flexibility Act.

- “Interest” and “Interests” refer to ownership of an LLC. “Interests” can be expressed as a percentage or in units. A unit in an LLC is often mistakenly referred to as “a share of stock.” More precisely, a share of stock represents ownership in a corporation, while “interests” represent ownership in an LLC.

The terminology adopted under this new Indiana law will undoubtedly cause confusion, particularly among lay persons who have not read and studied the statute. To understand what a “Series LLC” is and is not, start with these key statutory definitions-

- A “Master Limited Liability Company” is “a limited liability company that is formed under [the new Indiana law] whose articles of organization authorize the designation of one (1) or more series.”

- A “Series limited liability company” is a master limited liability company that has designated one (1) or more series.

- A “Series,” in the context of a series limited liability company, means a limited liability company series of interest established from time to time by the filing of articles of designation that:

(1) has separate rights, powers, or duties with respect to specified property or obligations; and

(2) to the extent provided for in an operating agreement, may have a separate business purpose or investment objective from that of:

(A) the master limited liability company; or

(B) any other series of the master limited liability company.

This illustration represents the basic concept-

In a sense, there is just one LLC in a Series LLC, and that is the Master LLC. However, each Series can hold its own assets, conduct its own business, enter into its own contracts, and incur liability in its own name, apart from the rest of the LLC, specifically apart from the Master LLC and apart from any other Series. In fact, a key part of the new Indiana law is to make clear that each Series has limited liability, if certain basic requirements are satisfied. More on those requirements in a future article.

To summarize so far, a limited liability company with articles of organization that authorize it to create one or more series is called a Master LLC, whether or not it has actually created a series. A series LLC is a master LLC plus all series that have, in fact, been created. And a series is a series of interests with separate rights, powers, or duties with respect to specified property or obligations.

Don’t Believe the Hype

With any new change in the law, especially when it appears that government has created something that might help businesses, there are a great deal of hype and excitement. Already, there are dozens upon dozens of articles, some written by non-lawyers, touting the series LLC as a great way to “daisy chain” several business operations and save costs in the process. Here are some of the false promises of the Series LLC, at least in Indiana-

- The Series LLC costs less in filing fees to form with the Secretary State.

- A Series LLC can file one tax return, thereby saving accounting fees.

- A Series LLC saves on administrative tasks and costs.

- The Series LLC guarantees limited liability.

Unfortunately, it is unclear that these promises will be realized. The Series LLC is so new and untested that many legal and tax issues have not been resolved. There are risks and uncertainty to using this new business structure.

In our next articles, we will detail some of the advantages and disadvantages of using an Indiana Series LLC. We will specifically address some of the false promises of this new entity structure. And, we will discuss alternative structures to the Series LLC that have been time- and court-tested.

This is the first article about the series limited liability company (the Series LLC) and Indiana law. We will be writing more articles on the Series LLC, as the law develops with an emphasis on holding real estate and other large assets in this new entity structure. Join our email list to get notified of new articles.