This is the second article we have authored about the Indiana Series LLC, which remains a relatively new business structure, having just become available on January 1, 2017. While the rules, regulations, processes and law on this new business model are incomplete and not yet fully decided, the law governing the Series LLC is developing faster than the law developed in the early 1990’s, when the limited liability company (the LLC) was first introduced in Indiana. Much of the law, especially tax law, that applies to the LLC is being applied to the Series LLC. That is making it easier and faster for the Series LLC to become a useful business planning tool.

This is the second article we have authored about the Indiana Series LLC, which remains a relatively new business structure, having just become available on January 1, 2017. While the rules, regulations, processes and law on this new business model are incomplete and not yet fully decided, the law governing the Series LLC is developing faster than the law developed in the early 1990’s, when the limited liability company (the LLC) was first introduced in Indiana. Much of the law, especially tax law, that applies to the LLC is being applied to the Series LLC. That is making it easier and faster for the Series LLC to become a useful business planning tool.

This article focuses on some the advantages and disadvantages to using the Series LLC for real estate investing, particularly for “buy and hold” investors. We also discuss some of the basic requirements that enable an investor to separate liability risks within each series. First, let’s review some of the basic concepts governing the Series LLC.

What is an Indiana Series LLC?

A “Series LLC” is a limited liability company with multiple and separate business purposes or investment goals being subdivided into groups, with each group being called a “series.” This new law introduces new legal terms, with these terms being critically important to understanding the Series LLC-

- “Limited liability company,” “interest,” “member,” “manager,” and other similar terms are defined under the new law as they were defined under the old law- the Indiana Business Flexibility Act.

- “Interest” and “Interests” refer to ownership of an LLC. “Interests” can be expressed as a percentage or in units. A unit in an LLC is often mistakenly referred to as “a share of stock.” More precisely, a share of stock represents ownership in a corporation, while “interests” represent ownership in an LLC.

- A “Master Limited Liability Company” is “a limited liability company that is formed under [the new Indiana law] whose articles of organization authorize the designation of one (1) or more series.”

- A “Series limited liability company” is a master limited liability company that has designated one (1) or more series.

- A “Series,” in the context of a series limited liability company, means a limited liability company series of interest established from time to time by the filing of articles of designation that:

(1) has separate rights, powers, or duties with respect to specified property or obligations; and

(2) to the extent provided for in an operating agreement, may have a separate business purpose or investment objective from that of:

(A) the master limited liability company; or

(B) any other series of the master limited liability company.

A Single-Entity Strategy

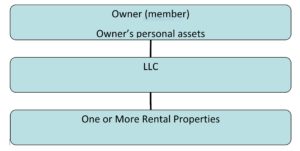

Most real estate investors begin with a single entity, often an LLC, to separate the liability risks of the LLC from the owner’s personal assets. This is how that structure appears visually-

This structure is common and provides a significant level of asset protection. With certain exceptions, liability stops at the LLC level, meaning the owners of an LLC are not generally liable for the bad acts of the LLC. A creditor with claims against the LLC could only seek to recover against the assets of the LLC and could not recover against the owner’s personal assets.

Unfortunately, if multiple rental properties are held under a single LLC, this primitive structure does not separate liability related to one property from the other properties. In other words, someone could sue the LLC and potentially have access to all the assets held by that LLC, and not just the property involved in the dispute that resulted in a lawsuit. Because a single LLC is inadequate to protect multiple properties held by a single LLC, investors often used multiple LLC’s.

The “Old” LLC Model

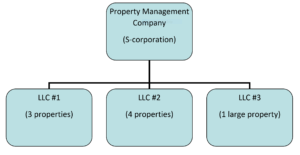

In the past, real estate investors used multiple LLC’s to “bundle” multiple properties in each LLC, sometimes with a separate entity, often taxed as an S-corporation, serving as the property manager for each property held in those LLC’s. This illustration represents the basic concept-

In this structure, each LLC is separately owned and operated, with separate bank accounts, separate charge accounts, separate branding, etc. The key to the asset protection strategy of this “old” model was to create separate identities, such that creditors could not confuse LLC #1 with LLC#2, or with LLC#3. This structure enabled an investor to separate liability risks, as opposed to having all the investor’s assets in a single LLC. So, if someone had a claim to assert against LLC#2, for example, the assets in LLC#1 and LLC#3 would be safe.

Additional risk dilution was accomplished by having property management delivered by yet another entity. In other words, the property management entity took on some of the risks of the business operation, freeing the LLC’s of those risks. If a tenant sued for housing discrimination, the property management entity would be sued, but the claims against the LLC holding title to the real estate assets would have defenses to those claims and would not likely suffer a judgment.

The “Old” LLC Model has been a very good structure for many real estate investors, especially landlords. However, this business structure is not perfect and fails to isolate risks as much as possible. As an investor acquires more and more equity in each property, there is pressure to create more LLC’s, adding to the expense and time required to maintain multiple separate entities.

The “Impractical Model”

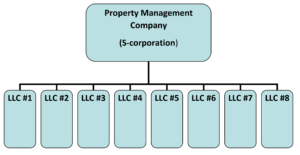

Prior to the adoption of the Series LLC in 2017, the following “Impractical Model” diagram represented the only way an investor could have separated the risks associated with one property from all other properties-

If an investor had eight properties, the investor would need eight LLC’s, each with separate bank accounts, separate charge accounts, separate branding components, etc. Each LLC would have to be maintained and operated separately. As a practical matter, this structure was costly and cumbersome. Consequently, this “Impractical Model” was not a good fit for most investors, particularly if the investor had limited equity in the properties or had used debt with cross-collaterialized mortgages on most or all of the properties.

The New Series LLC Structure

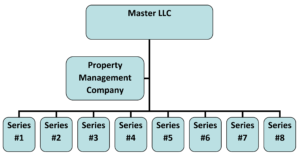

The Series LLC allows us to consolidate much of the management of the business operation, while separating liability on a property by property basis. While the structure looks similar to the “Impractical Model” illustration above, there are significant differences in how the LLC and the Series LLC function and provide limited liability across multiple properties. Here is what the new Series LLC structure appears-

Each Series can hold its own assets, conduct its own business, enter into its own contracts, and incur liability in its own name, apart from the rest of the LLC, specifically apart from the Master LLC and apart from any other Series. Indeed, a key part of the new Indiana law is to make clear that each Series has limited liability, if certain basic requirements are satisfied. More on those requirements below.

Each series would enter into a separate property management contract, although some lawyers suggest that the Master LLC can execute contracts on behalf of each series. The latter approach is unnecessary and risky. The attorneys at GRIFFITH XIDIAS LAW recommend that each series enter into its own contracts without the involvement of the Master LLC.

The greatest advantage of this structure is that the collection of rents and the payment of expenses can be consolidated, as long as three requirements are met-

- The Master LLC and each series must be properly created by filing certain documents with the Indiana Secretary of State;

- The organizational documentation to form the Master LLC and each series must be carefully written and must contain certain language; and

- There must be a detailed accounting of the financial operations of each series.

A good business lawyer can assist a client with the first two requirements, but the third requirement places a burden on the managers of the Master LLC to keep good records. This is really the key to taking advantage of the limited liability afforded by the Series LLC. To make the point, here is the key language from Indiana Code Section 23-18.1-5-1-

The records maintained for the series [must] account for the assets associated with the series separately from the other assets of the master limited liability company and any other series of the master limited liability company.

If a landlord does not have the personnel (bookkeepers & CPA’s), software, processes, systems and/or discipline to keep detailed and accurate records to identify the assets associated with each series separate from those of the other series, then the Series LLC is not a good entity selection for that investor. But, if an investor employs the right resources to maintain the records for the assets of each series separately, then the Series LLC could be the perfect entity choice.

Again, we cannot overstate the importance of this record-keeping requirement. Once a lawyer properly forms and documents the Master LLC and each series, the recording keeping becomes the key to defending a lawsuit or claims aimed at defeating the asset protection created by the Indiana Series LLC statutes.

As with any important business or legal decision, it’s important to consult with a knowledgeable and experienced business lawyer. The concepts discussed in this article may not apply to your circumstances and are certainly not a comprehensive review of the Series LLC. If we can be of assistance, please contact our office to schedule a consultation.